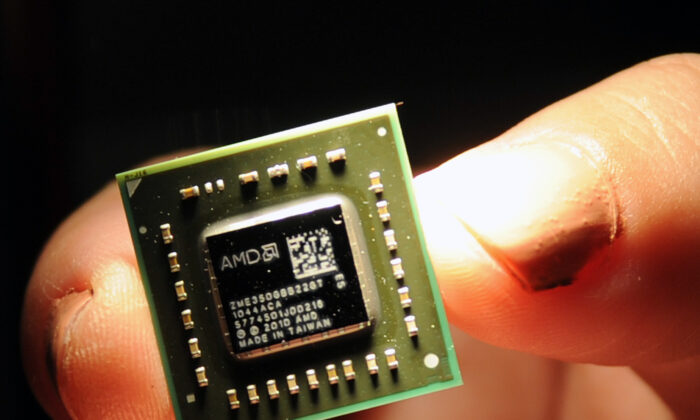

The upcoming US expanded regulations were issued to prevent China from gaining access to complex semiconductor production.

In an unprecedented coordinated response in Washington, Chinese trade associations informed Chinese companies on December 3 that it was “no longer safe” to buy American chips.

4 Chinese language trade associations represent approximately 6,400 corporations in the country’s largest industries, including the telecommunications, virtual generation, car and semiconductor sectors.

China’s Web Nation has advised companies to increase cooperation with chip companies in other countries and prioritize the use of Chinese-made chips, declaring that US export controls have “significantly harmed” the Chinese Internet industry.

The China Association of Converse Enterprises said it does not regard U.S. chip products as of security or importance and that Beijing should investigate the way it stocks the country’s critical data infrastructure and supply chain.

Despite export controls, Chinese state-backed chip companies have resorted to intermediaries and loopholes to continue acquiring technology as restrictions tighten in 2023 and 2024, according to the US Trade Zone, the United States.

China is currently a major buyer and seller of large chips. Many foreign chip makers have plants in China, and Chinese consumer goods manufacturers need large quantities of chips. U.S. Commerce Secretary Gina Raimondo said earlier this year that about 60 percent of all legacy chips over the next few years will come from China.

While foreign chip makers have told investors they are preparing for further restrictions on selling to China, many said China remains a major market for older chips and they expect national security-related exports to decline. Despite the controls, it will remain a major market in the years to come. ,

“But it seems quite clear that the gloves are off now,” said Tom Nunlist, associate director of research firm Trivium China.

The new ban includes gallium, germanium, antimony, super-hard fabrics and graphite.

Gallium and germanium are important for semiconductor production, and China has lagged behind as a producer of each mineral.

In recent times, Western countries have tried to reduce their dependence on China for critical minerals, which can be vital for production and military construction. The CCP has a history of leveraging China’s position in the supply chain for global negotiations.

Reuters contributed to this file.